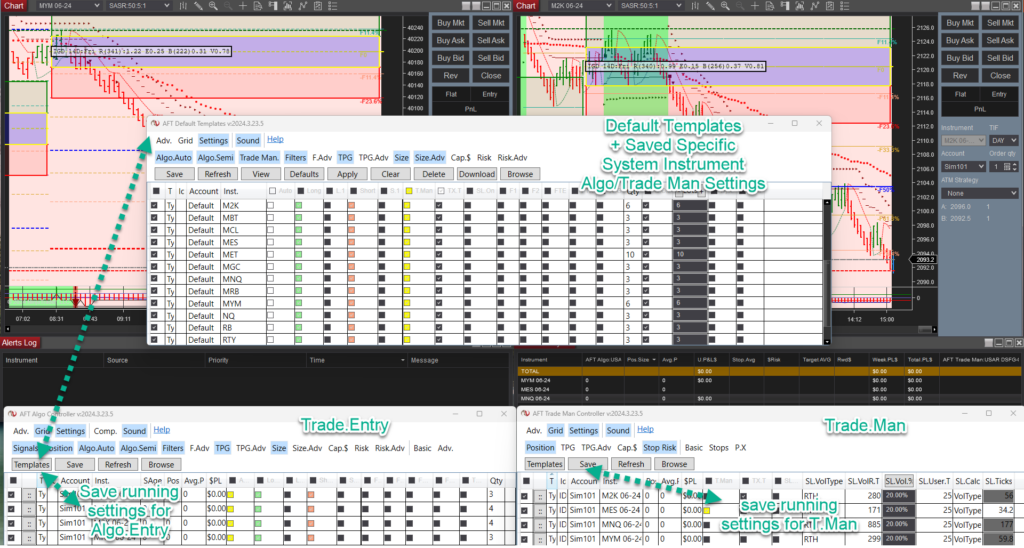

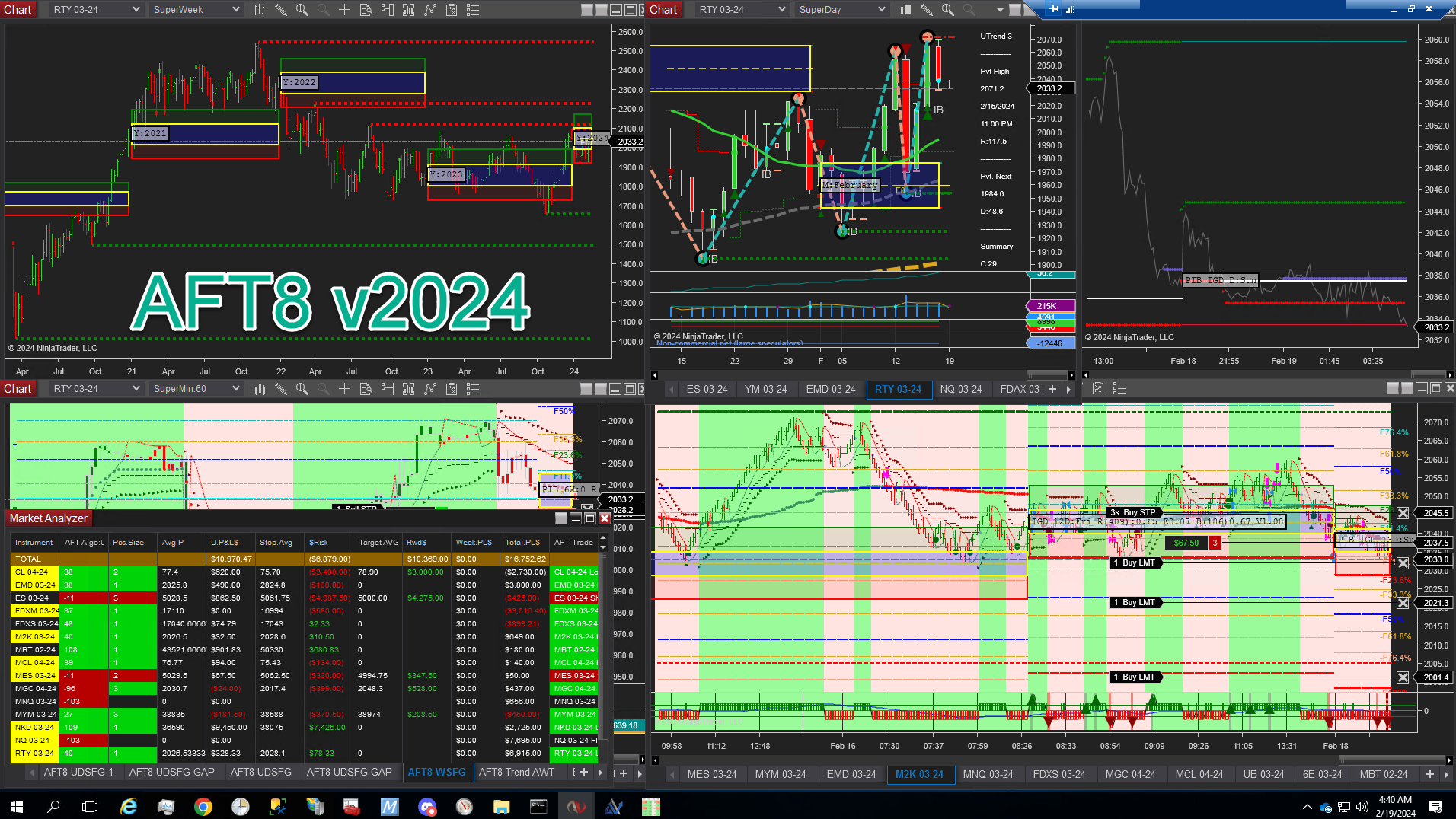

Updates and releases

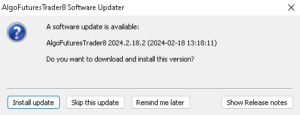

AFT8 updates and ATS Desktop apps were released over the weekend 2024-03-24

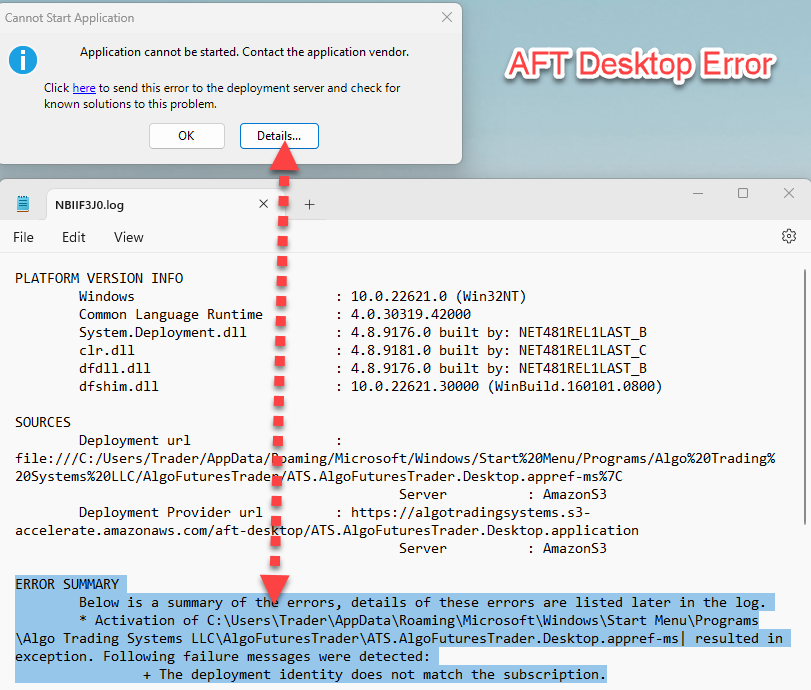

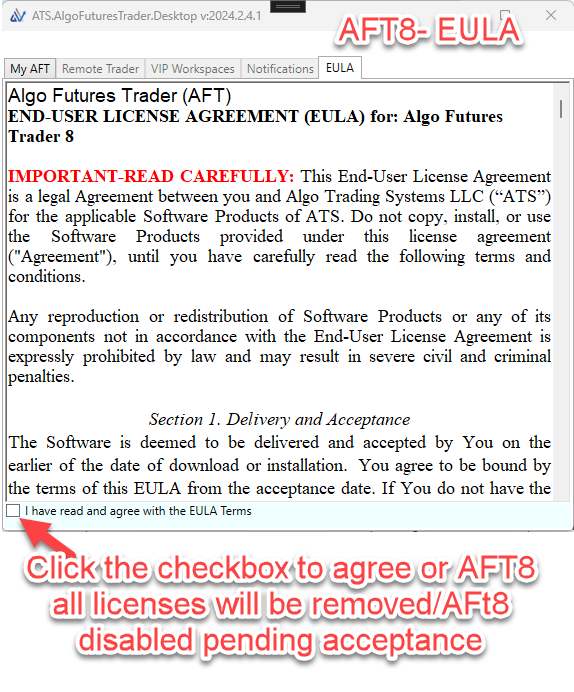

App Breaking Changes

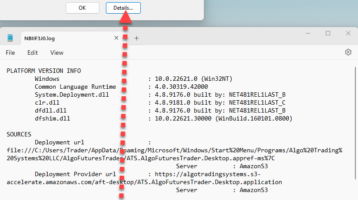

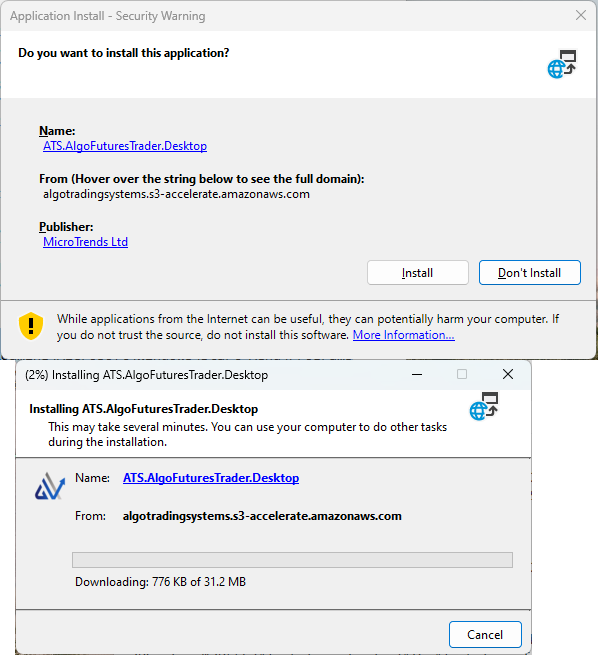

Apps now use a network accelerator deployment URL for speed for global installation.

Apps affected:

- AFT.Desktop

- AWT.Desktop

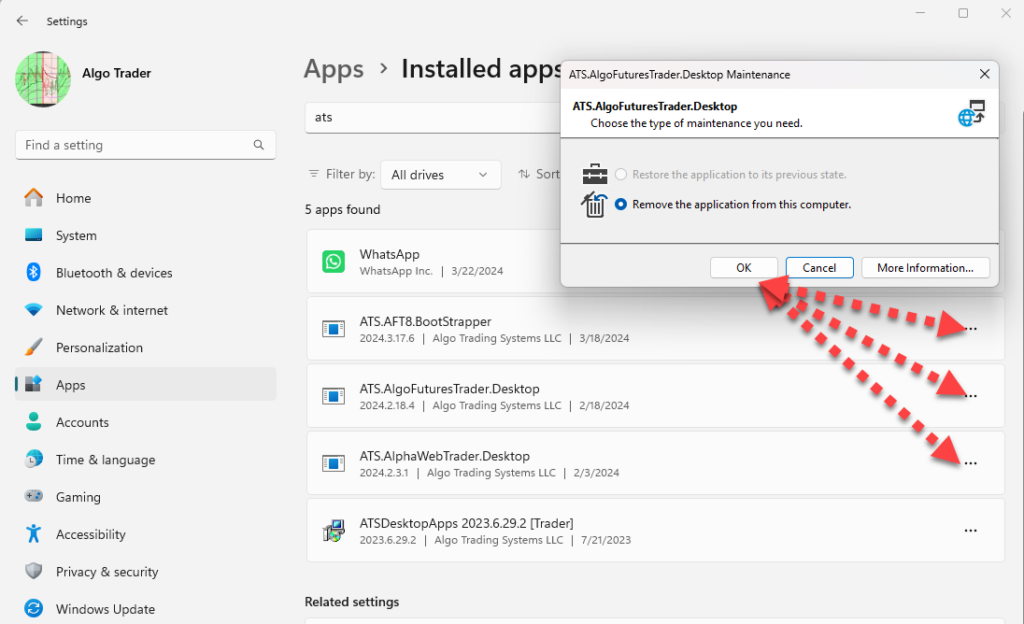

The prior version installed apps will not start and will require uninstalling:

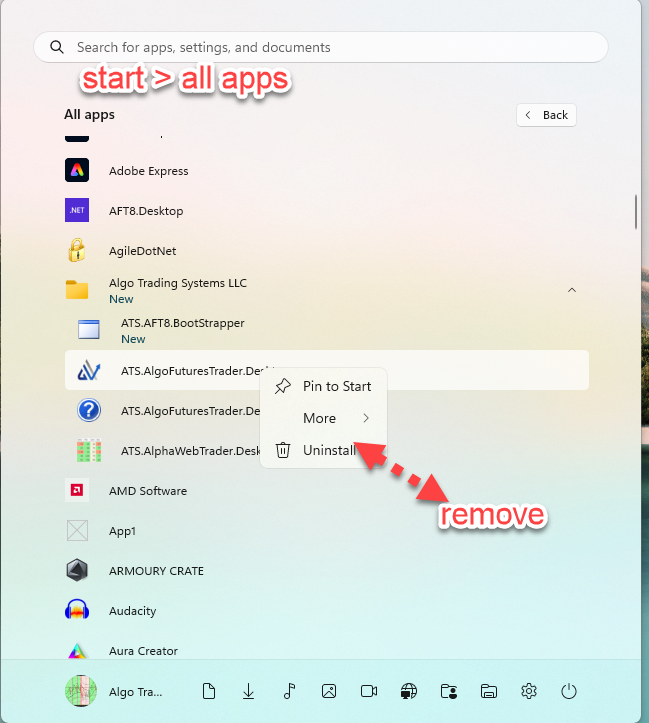

Uninstall:

How to uninstall ATS Desktop Apps

It is critical to uninstall old apps before installing the new apps to avoid conflicts and errors.

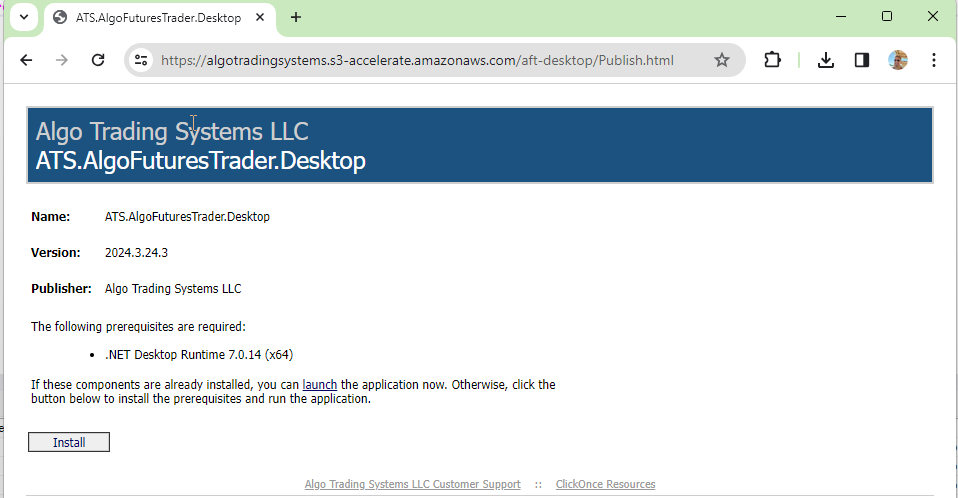

Re-Install:

Download the “ATS Desktop Apps” Installer:

Run and install apps:

how to install ATS Desktop Apps