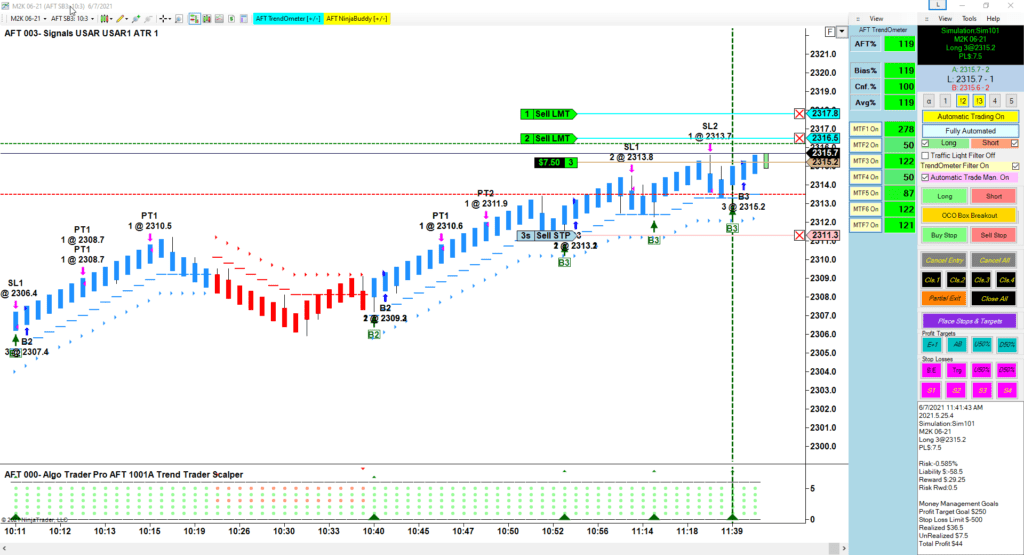

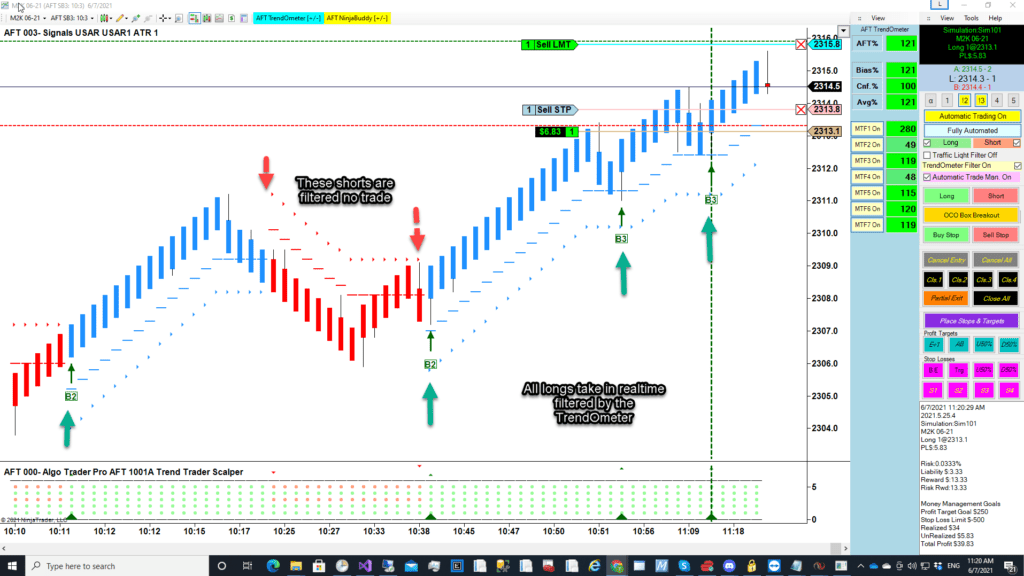

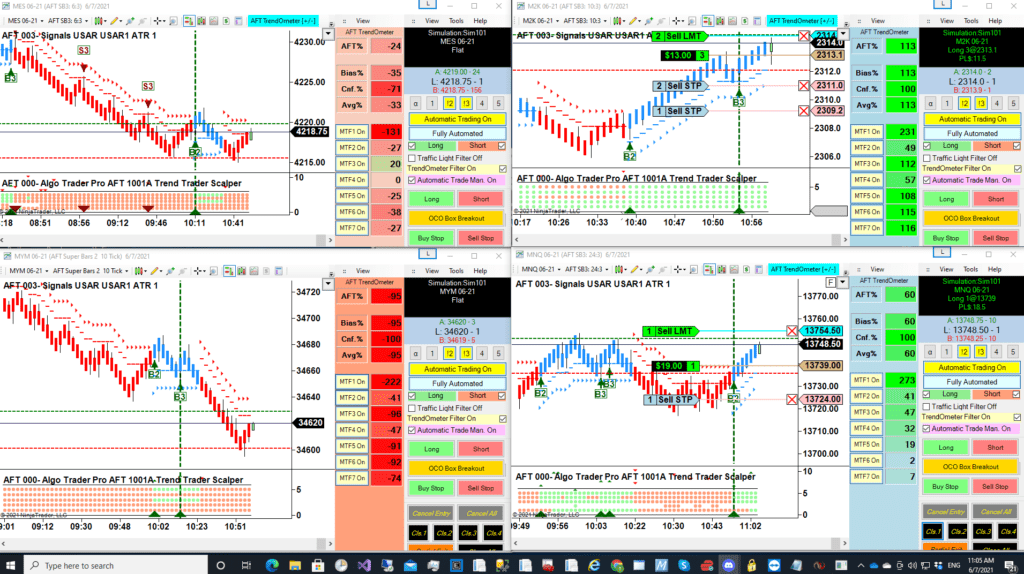

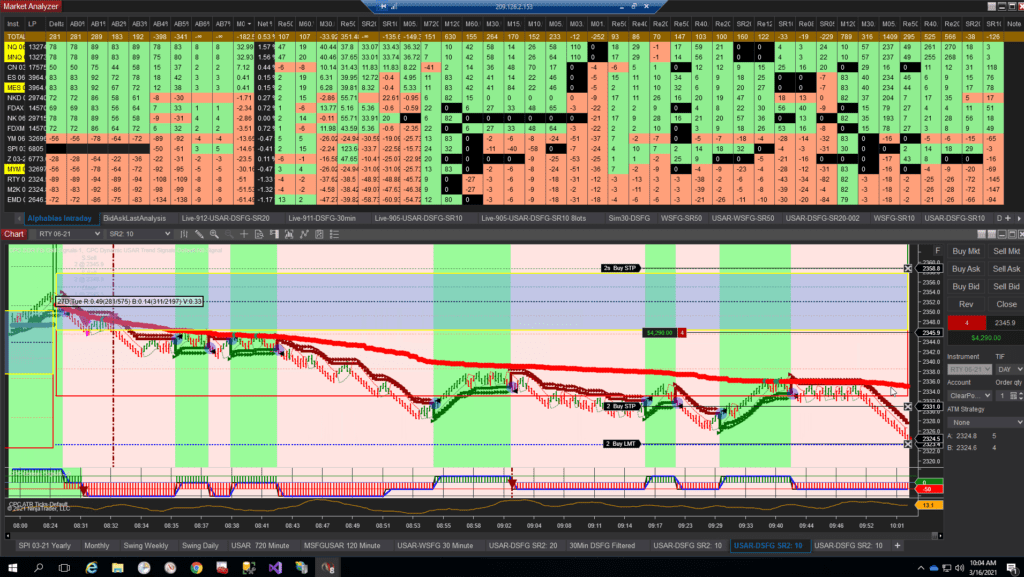

The featured post image is a fully automated algo trading Russell 2000 with the Alpha bias intraday near and medium terms trend correlation module – this is only 1 part of the full gamut system of futures indices I use for my hedge fund trading, some features of which i am porting into the AT8 system to contain a subset of the hedge fund futures portfolio trading system. Traders, yes we really trade professionally with this tech and i don’t mean to entice by showing a real trade with real cash – i make no song or dance – big deal yet another picture of a trade, yawn… that’s a scalp in the grand scheme, but the point is, it shows a NYSE daily session breakout fib grid SFG daily short signal taken and traded and the use of the grid for targets and stops and the full version of Alpha Bias trendometer which AFT8 is spliced from…a matured trading technology only now being released after many years of usage and battle tested in live real money hedge fund trading with millions of USD for risk capital using advanced servers and technologies costing some $100KUSD per annum to run it. Now being brought to you in small form factor for desktop retail trading for you to get started day trading futures…with real deal trading tools for NinjaTrader 8 so you can trade like a pro with an edge from real deal trading systems and methodologies – AFT8 will lead the way as the best trading system for NinjaTrader from the MicroTrends hall of fame of trading systems.

So yes AFT8 will have a very similar shape, form and function, but more lightweight interactive features so it can be fully or semi automated whereas the hedge fund system is 100% algo… really not suitable for 99% of retail accounts sizes and tastes, so don’t worry AFT8 is a much smaller piece and more controllable, therefore a small price and is free unless you live trade with it.. and as the original architect and pioneer of hybrid algo trading systems we will provide features to allow easy trading and management of day trading size/small accounts – but we need time to code and release – step by step -so the next step is to add the trend correlations as below.

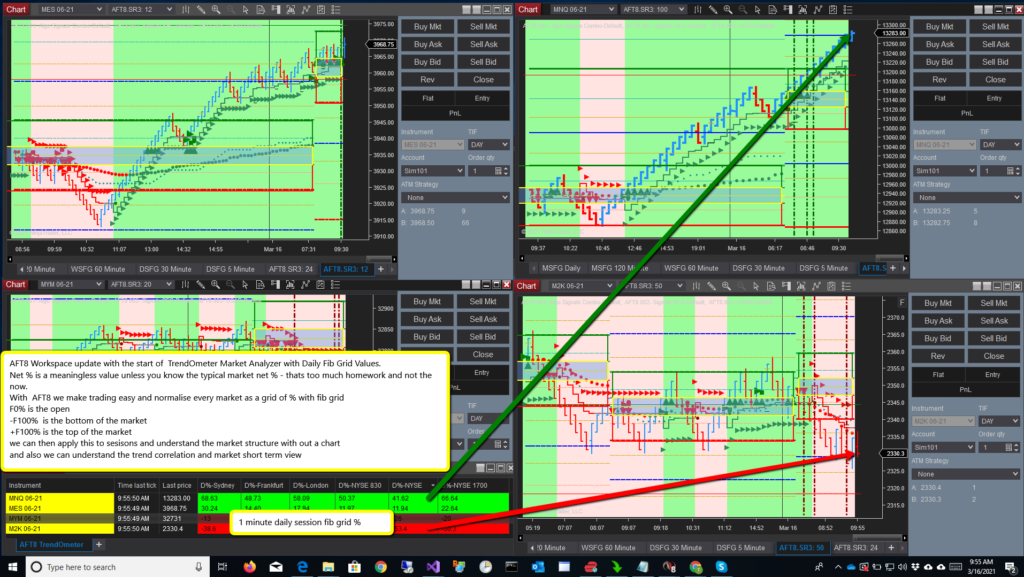

So the latest AFT8 Workspace update has the start of TrendOmeter Market Analyzer with Daily Fib Grid Values.

Net % is a meaningless value unless you know the typical market net % – that’s too much homework and not the now it’s yesterday. We want to see today and the current Realtime situation in the live market.

With AFT8 we make trading easy and normalize every market as a grid of % with fib grid

F0% is the open

-F100% is the bottom of the market

+F100% is the top of the market

So we can see where the price is as a % we don’t need the price – price is meaningless also without knowledge of price levels. The current Fib grid % is the key to understanding the market view from a particular session start at 0%.

We can then apply this to sessions and understand the market structure with out a chart and know the story of the market from the prior session to now or further back at a glance. Critically we can understand the trend correlation and market short term view -is is a mixed up jumbled up market or is it a moving trending flowing directional market with a decisive trend up or down -these conditions and identifying them and how to trade them if at all or to sit on the side and wait is the key to trading a trend from the beginning to the end -the trend is your friend until the end, let winners run… these clichés are timeless – and they really work.

To get the latest code it should automatically update after you restart NinjaTrader 8 within 1 day -however if you want to manually get the update you can simply run your installer from your PC again and it will grab the latest code and installer workspaces and install. Please visit the Algo Futures Trader downloads page for details.

Traders all the best with your trading… drop us a line at support for any feedback or let us know how its going.

Many thanks, Tom.