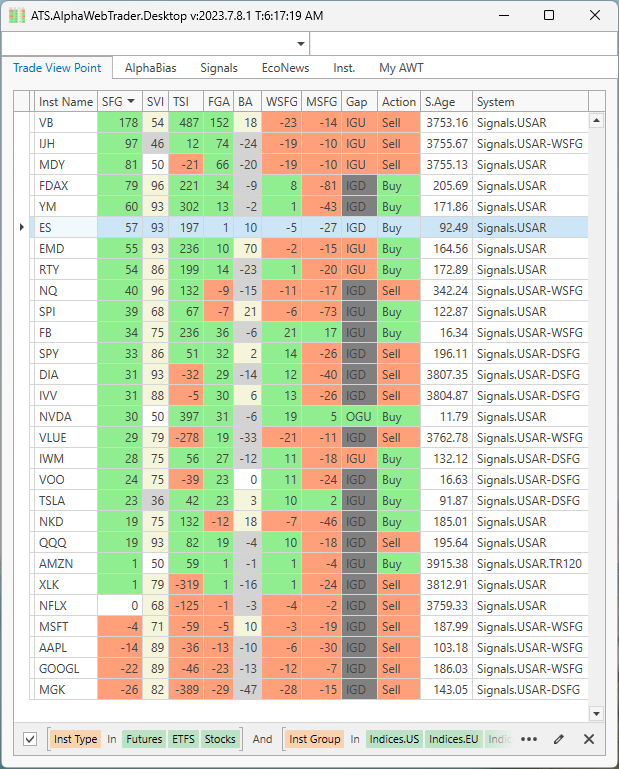

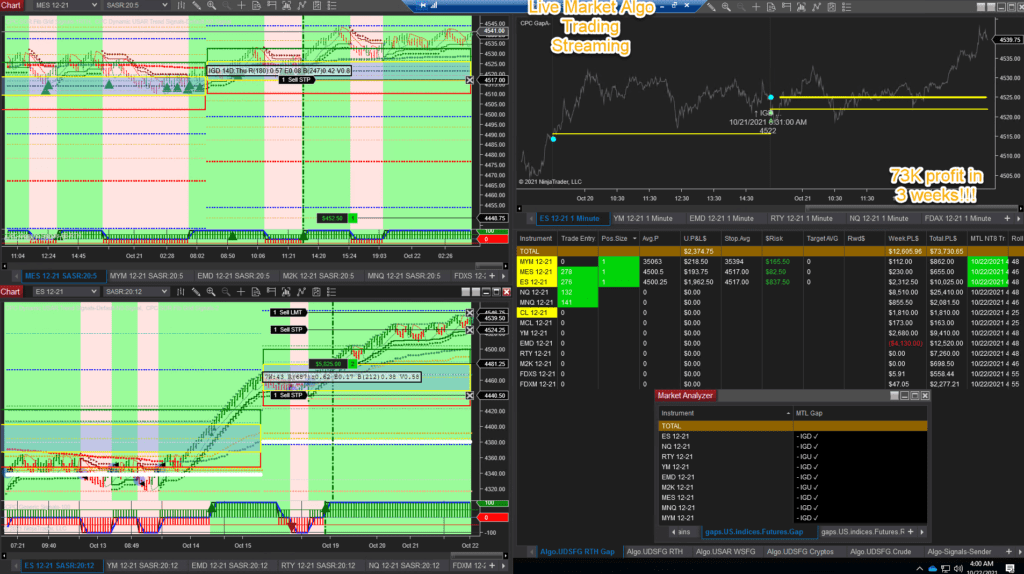

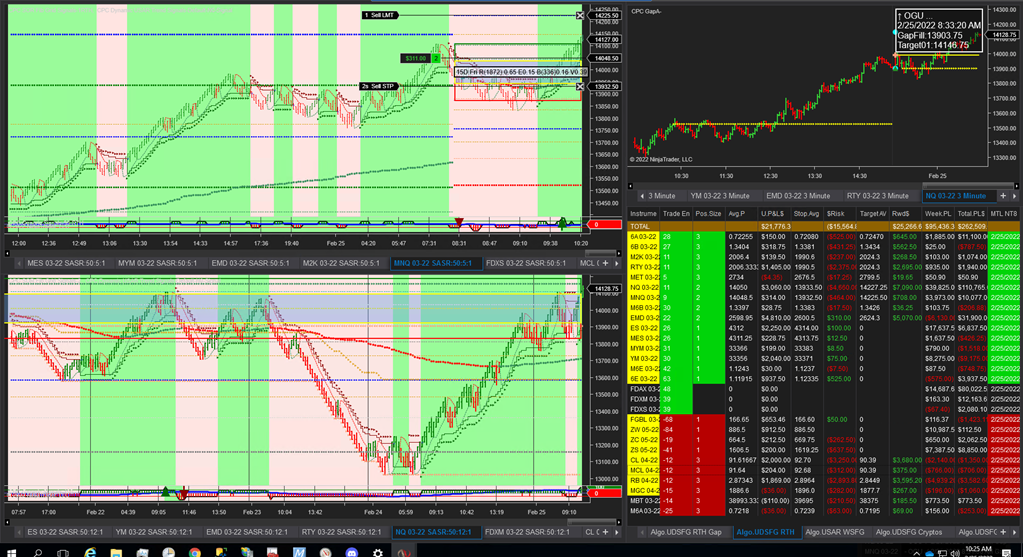

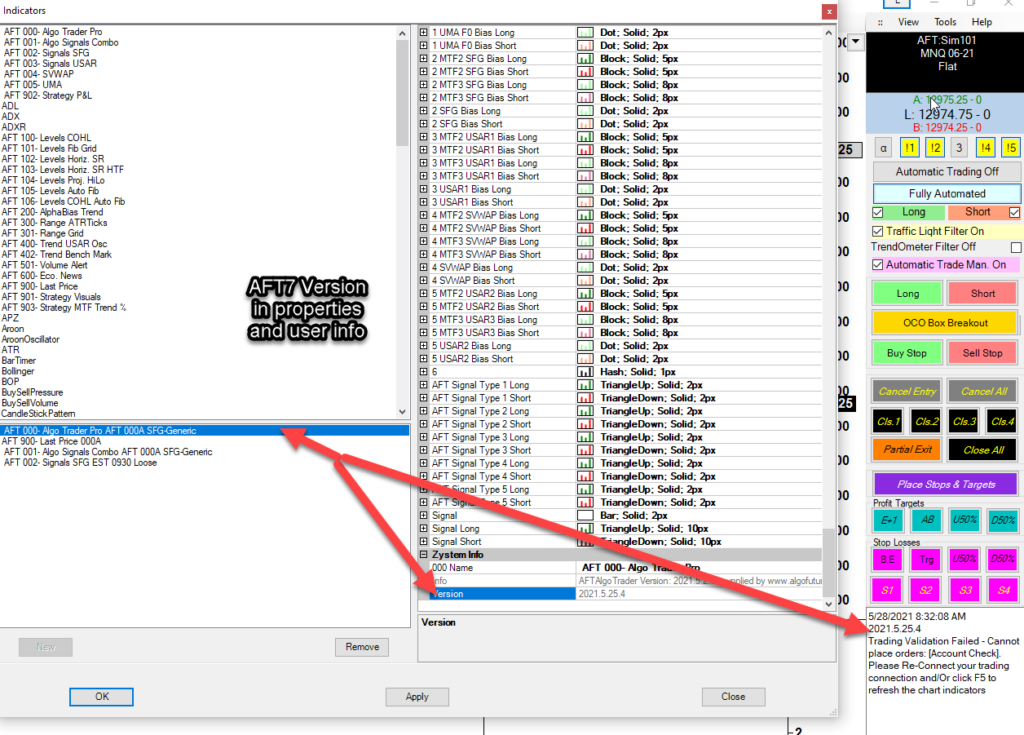

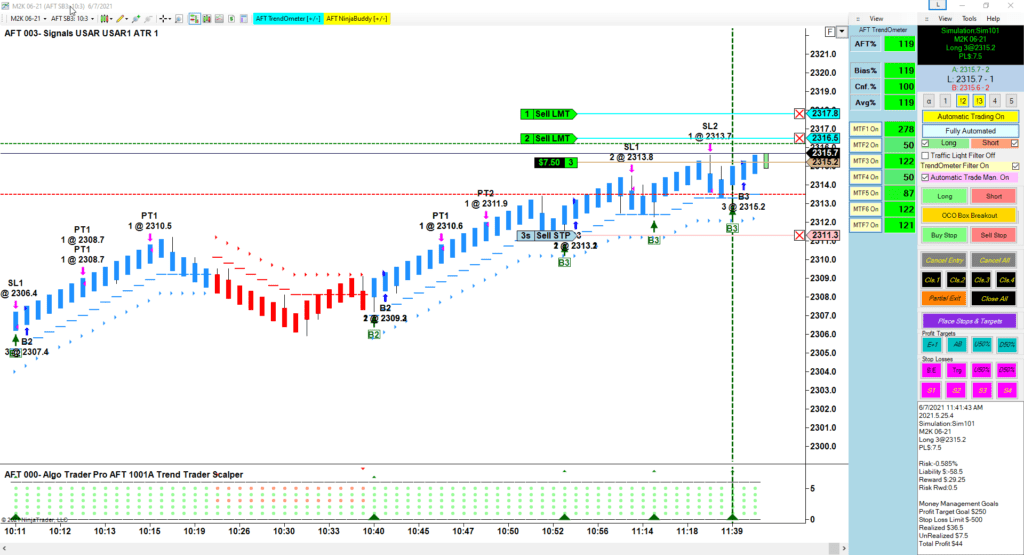

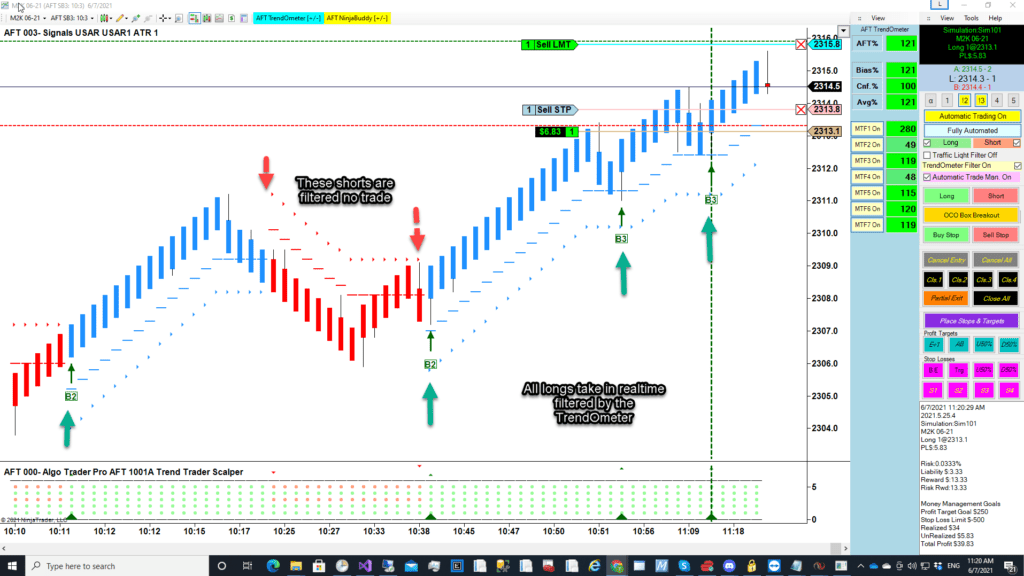

AFT starts AWT.Desktop alongside for use for API and systematic hybrid algo trading confirmation,

its the desktop version of alphawebtrader.com

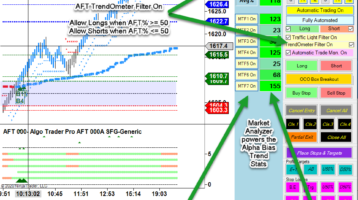

AWT.Desktop has been going through some enhancements and polishing to make it useful for free and paid up member traders. AWT.Desktop will now show all screens to free and paying AFT members so it can be used as a lag free trade confirmation system and real-time signals.

AWT.Desktop is built with cutting edge tech and resolves the problem of datalag when there is too many instruments or charts open- AWT will never slowdown your computer or NinjaTrader!

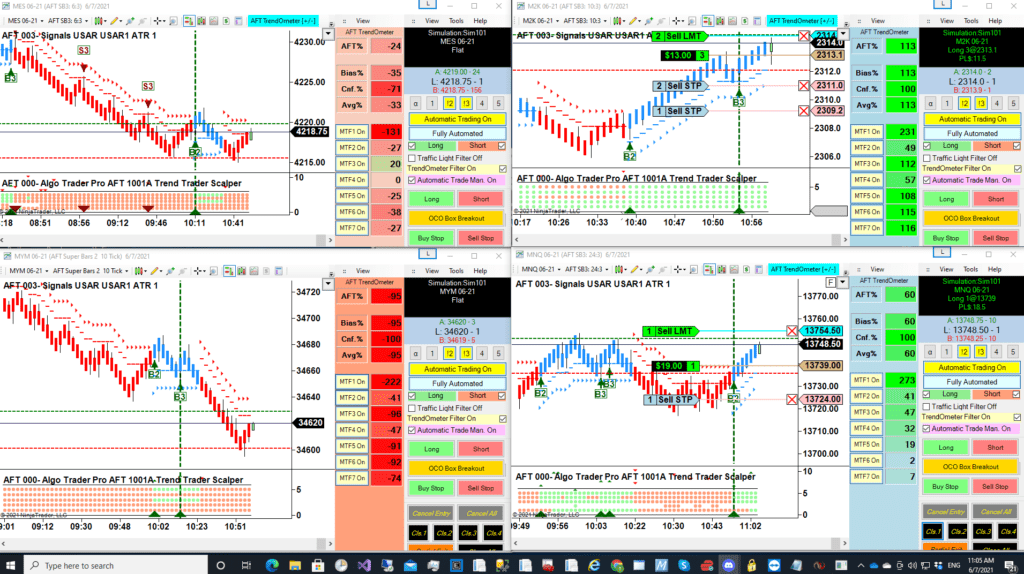

- Free members it will update screen views each minute.

- Now with trade signals based on your filters and voice!

- Also ability to save layouts.!

- Settings saving for voice and alerts/sound