With regret as the sole creator and developer of AFT8 i have to inform you that I was out for the count for 2 weeks with a fever and throaty cough and i’m not sure if it was COVID or flu so I made no progress at all on the AFT8 update sine the last version mid March – however i am glad to say i am pretty much recovered except for lingering lethargy and have been coding again.

AFT8 is still in a beta and has a long way to go before all the planned features are released.

It will be worth the wait, it needs to be its going to be my main retail account trader.

Ok so there will be updates of the AFT8 system from next week –

fixing of bug to save settings on the main signals indicator, ease of use feature for configuration

and some inclusions of swing trading/ weekly fib grid trading features in the turnkey workspaces. Here’s why.

AFT retail day trading version of software came from a much larger swing trading multi server, client/server n tier, SOA, cloud based system with NT8 at its core providing the awesome technicals, execution and trade management. AFT as such contains a small subset of the functionality but exactly enough for the algo premise and capability for day trading and some swing trading but with user interactivity for many of the tasks. The hedge funds system will cost you 50KUSD plus fees and data server overheads per annum to use. AFT retail starts at free…. The following will give you some idea about the 2 versions.

So during that time of my absentee the CPC/AFT Hedge fund systems continued to work even though the developer algo trader was not in attendance. The servers restarted each weekend via windows task scheduler and update themselves, NT8 is then started and historical data is downloaded each for the last week and replicated out from a main server to other servers to negate the need to download again.

With the full hedge fund version – there is no need for a user at all -except for rollovers and in emergencies or system selection – it is 100% fully automated trading in the real sense and i am not allowed even if i want to intervene. Not allowed to enter or close a trade, move a target, trail a stop… so we get a pure dataset of stats. Sometimes it means there were trades i would not have done but some it does incredible trades that were far better than me, over time it works and that is the goal.

A hedge fund performance has to be measurable to something tangible and risk control also so removing all humans is the way to do it ideally as a human is hard to backtest and benchmark. They get sick too or move jobs… so when i’m talking fully automated its big trade accounts and no fiddling or making it up as you go.. all the systems that make it to live from the 1000s that don’t go through system selection, board approval and compliance for annual auditing – no pressure 🙂

AFT retail traders benefits from a hybrid feature set to allow fully as well as manual/semi automated trading which is really very important for retail day trading as it is less forgiving than swing trading. AFT benefits from many years and many 100KS USD of research and development and real trading of the systems professionally in automated swing trading and they end up as much as possible as turnkey for day trading with minimal tweaking required.

CPC /AFT algos for the hedge fund start on a Sunday, the week begins, the windows task scheduler process with start NT8 in time to trade the CME open for indices, connecting to various datafeeds in turn for each exchange and feed -then loads the workspaces and loads the algos and starts them a mix of sim and live. For each system each algo will inspects orders and removes any anomalies within NinjaTrader and then processes the positions and orders, risk and technical context and continues trading where it left off adapting to any changes and implement fault tolerance and safety.

Technically the CPC /AFT algos are part of a a greater system – a signals framework, execution management system (EMS), order management system (OMS), position and trade management, rollover liquidation, data acquisition , automated web stats collation and reporting system and automatic trade safety system and more besides- evolved in NinjaTrader and .net, .net core, asp.net core, MSSQL and Azure service bus, created over a 4 year period.

It is quite incredible what we have achieved with the technology directly due to the amazing work of the NinjaTrader development team to allow us access to all areas to create what we want limited by imagination and skill only. So in short even though the developer was away and useless the system continued onwards fully automated regardless so no trades were missed an no one goofed things up with under par irrational decision making.

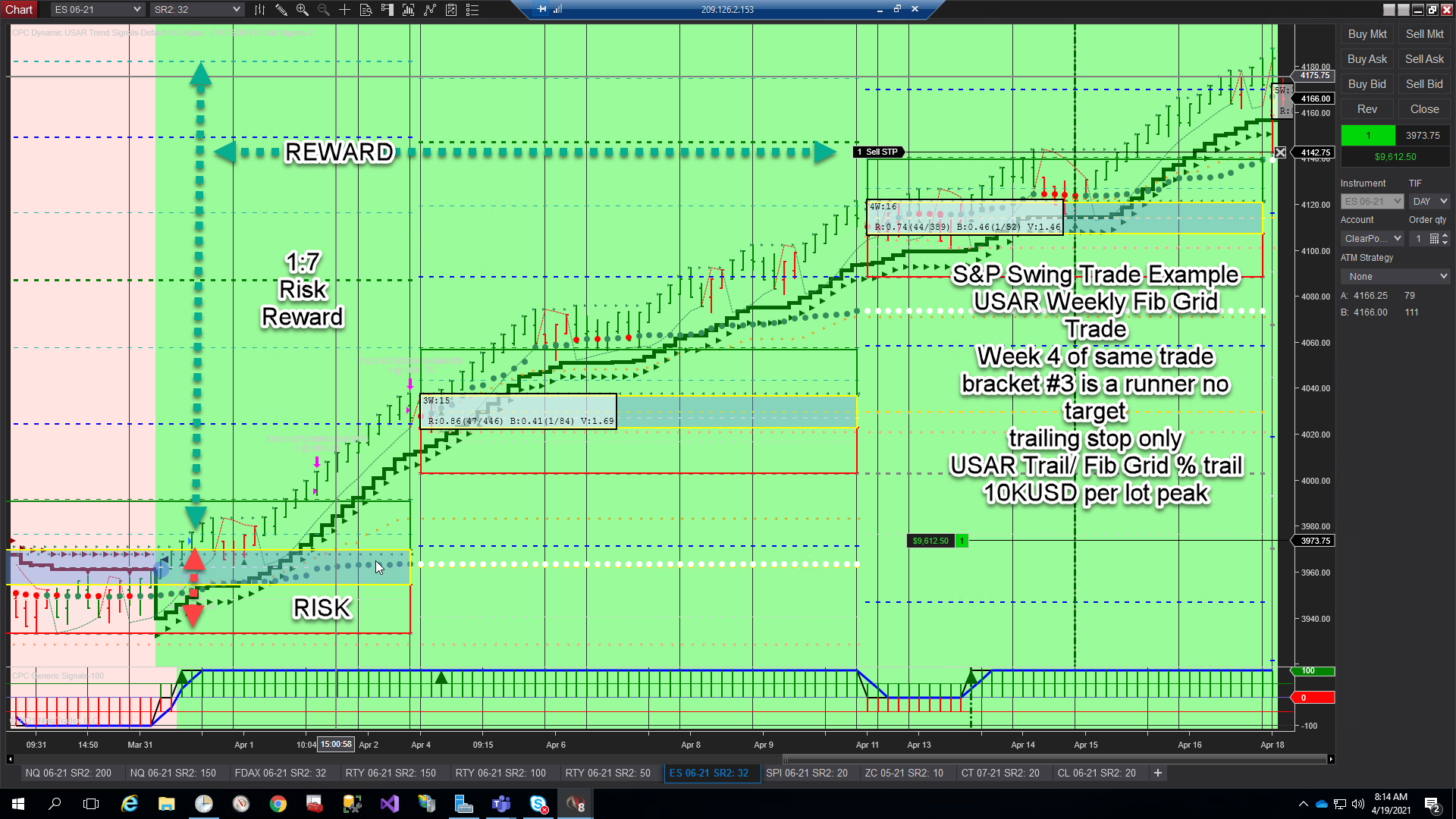

In my absence then here is a pretty good trade example of the CPC/AFT Weekly Swing trading algo took up to the high last week 2021-April-16. Now reversed and closed into a small short this week- 10K per lot was the MFE trading Emini S&P – just with a 4 lot trade of about 5K to $7500 Risk on that volatility. It could have been a lot more based on the past and recent times but its still a respect worthty demonstration of what we can achieve with the tool set.

We will provide this WSFG weekly setup as part of AFT8 turnkey settings for micro indices and Emini so that traders can use it as a guide for intraday or indeed take the weekly SFG Signals.

As you can see yes this is a live trade note that chart trader is black and the account does not being with Sim…we really do trade and we really do use these tools – The AFT day trading system is a version built for small account trading based on the professional hedge fund trading for which it was originally created. So the day trading version is basically a daily session breakout instead of weekly for swing trading. You can also see the power of the risk reward in action on this type of system and the staying in trend following method.

AFT8 is available in the shop as free product AFT8 Free Trading System or available from the AFT download page

Articles and videos will follow on installation but should be very simple if you can use a mouse and pc and get around any AV warnings etc. – please visit the support and help desk