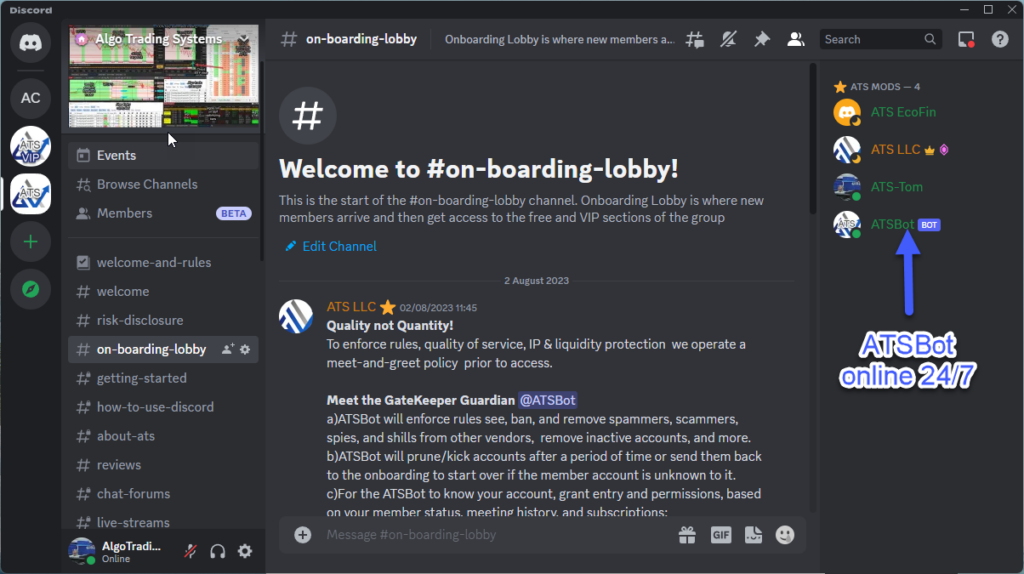

MEET ATSBot the GateKeeper of the Group.

ATSBot discord robot will assign the discord group user role “ATS Group” providing access to the Free Main Group Areas of the group, and will also provide VIP access for qualifying traders!

To progress we need to focus on the essentials so we don’t waste time and resources on low-value tasks such as group admin. So the ATSBot has a job to do this, therefore the caveat is traders who don’t do the entry process will be excluded.

Since going live the ATSRobot has pruned 100s of trader accounts who are scammers, spies, shills plagiarists from other vendors, inactive accounts, time-wasters, and possibly a few bonafide members who have not been picking up the news and have been kicked out or downgraded as they have not linked their discord accounts or have not gone through the onboarding process – get Started Meeting, bonafide members can rejoin and get linked up here from their account: https://algotradingsystems.net/TradingGroup

ATSBot Member Acceptance Criteria

Checks the history of each member prior to acceptance for access levels

1)ATS universal account is linked to the discord username.

2)Trader attended a Get Started Meeting or has a qualifying usage record

KYT/KYS – Know Your Trader/ Know Your Supplier – Get Started to Meeting https://calendly.com/algotradingsystems/get-started

We want to know all our traders and meet you 1 to 1 and make sure it’s a win, win situation. If you do not want to do this then this group and trading systems software are not for you.

To maintain high standards, quality, and compliance and to keep out: time wasters, reduce support overheads, scammers, and beginners “white belts” who slipped through the net.

Member Qualifying Usage Record:

ATSBot primarily checks for a “get-started meeting” or additionally checks for the following records:

1) Any License Software purchase records

2) ATS Universal Account – 3 months+

3) ATS Group join date – 3 months+

4) Multiple Login records first and last

5) Multiple User Sessions first and last

HELP! The ATSBot Kicked me out or downgraded my access

A) Then you were inactive or not linked up

B) No get-started meeting and no qualifying usage record

SOLUTION: Attend the 100% FREE Get Started meeting

.https://calendly.com/algotradingsystems/get-started

1) Group Access to all areas to collaborate and get interactive support

2) Tech setup, product tour, ready-to-trade, free coaching session!

3) PLUS you get a free 30-day ATS Ultimate live license!

4) PLUS Free trader review after 14 to 30 days.

5)Reduce the learning curve and support overhead, get a head start, and make sure you are on the right track.

AWWWWW Can’t you just let me in?

NO OVERRIDES NO EXCEPTIONS

N.B: There are no overrides in place so the robot has ultimate control over entry. So for example, if you were provided entry and did not book your get-started meeting or have qualifying usage record ATSBot will remove access. This means some members might have downgraded access or have been pruned/kicked but can rejoin.

Robot Error or User Credential issues.

If there is an error in the Robot and it wrongly excluded a member this will be fixed please report to support: https://algotradingsystems.net/Help